GLD 3/10/23 - 3/17/23 - Safe Haven Trade, Banking Crisis

Variables

- Tightening of monetary policy and rising interest rates led to accumulated stress on the banking system which resulted in bank failures, which led to buying in gold related products, like $GLD SPDR Gold Shares

The Big Picture

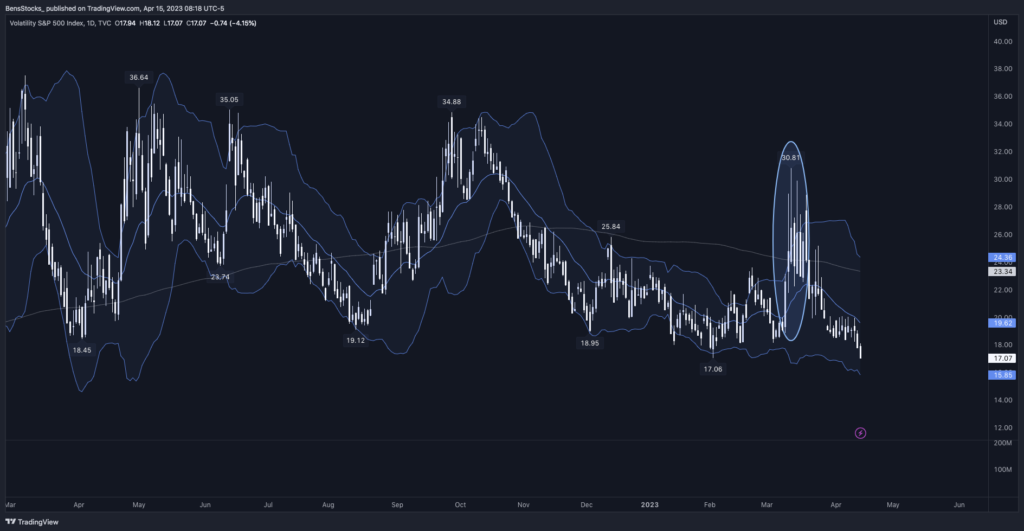

- Participants were focused on calculating the implications of the bank failure(s), and how this would affect the path of interest rate hikes from the Federal Reserve. The VIX reflected this uncertainty spiking as high as 29 (+24%), but closed the session just below 25 with a (+13%). The SPY lost (-2.35%) over the course of two trading sessions, as the bank weighted names weighed in the S&P 500 EETF

Analysis

- Participants fled to real assets like gold as the banking crisis of March 2023 rippled through Wall Street. Per the annotated headlines you can see the day on which SVB headlines hit the tape, which led to an appeal for “safe haven assets” like gold.

Stock Selection

What led to this stock being in play, and what other factors were relevant when selecting this stock to trade? Does this stock have + EV, and do I have an edge in this stock? *IMPORTANT

- Once I have the thesis of the safe haven trade, I next need to select a product to express my idea in. I opted for GLD–the SPDR Gold Shares–which is the largest physically backed gold exchange traded fund (ETF) in the world. This will indeed create the desired “safe haven demand” because the ETF is backed by physical gold.

- One of the cons of this product is I have to calculate the possibility of a large overnight gap down against my direction into the trade (risk parameters, sizing, taking profit to give cushion), because gold futures ($GC) trade overnight

Trade Strategy

- How are you going to put on this position (entry)

- Given this is a swing trade idea, I would be using higher time frames to enter and manage my position. On 3/10 GLD gapped up (+1.03%), and from my perspective this was the first actionable sequence in the safe haven trade idea: I would look to get long equity off the open if I saw strong volume coming in and interest from buy-side participants off the open, with my risk to the opening price or slightly below it. Gap ups on elevated volume can lead to significant changes in a stocks character, and gives me the confidence that the gap will hold and therefore my entry and risk are great for this trade. I am looking for a move to ~ 182 upside target

- How are you going to manage that position once it is on?

- As mentioned above since this is a swing idea, I want to managing the position off higher time frames (TF): 30 minute and daily charts for the most part. Once the trade is on and GLD closes at its highs I am looking for: gap ups on elevated volume and GLD does not go for a gap fill, rising 21 period EMA to act as support for this cycle (trend), no closes below 5D EMA, and I want the sentiment of safe haven demand to carry on for weeks. I will move my stop based on the chart pattern that develops (See trade management)

- How and why are you going to exit this position?

- Reasons2sell before target:

- breakdown from periods of consolidation, i.e. gap fill

- sentiment shifts dramatically, no more fear regarding banking system leading to change in character

- rising moving averages do not act as support (caution)

Trade Management

Review

How can I trade this better next time?

- One idea that comes to mind is if there was a better product to express this idea with, i.e. options or gold futures vs equity. All come with their pros and cons in my opinion, and GLD being the largest physically backed gold ETF in the world made it the top candidate for this trade.

How can I find more of these types of trades?

- I would not have had this idea if I was not immersed in the market each day and being able to understand the catalyst is very important.

–Ben