A good decision

When we think about good trades and break down the components of a good trade, what it really comes down to is a decision to buy or sell a security. It is for this reason that having a good decision making process is essential to developing as a trader. A decision should be evaluated on the merits of an individuals trading process. Although it may sound like a simple choice between which side of the trade you want to be on (or if you want to put on the trade at all), professional and experienced traders develop a robust process to evaluate their decision making in real time based on the type of trade they are about to put on and the variables in play. This blog is not specific to my decision making process, rather it approaches the essence of good decision making from the research I have gathered and based on my own experience. This post assumes the reader is familiar with the fundamentals of a sound trading plan, such as a thesis, an entry price, price targets, and stop loss.

dealing with uncertainty

Trading is by nature, an exploratory process in which we venture into the unknown on a daily basis. Each time you reach a decision to initiate your position, and as soon at that position goes in your book, you enter into the domain of the unknown. In Jordan Peterson’s “Maps of Meaning”, he states that “The existence of the unknown, paradoxically enough, can therefore be regarded as an environmental constant.” In other words, the fact that the unknown is always present makes the unknown a constant. It is always there, waiting to consume you when chaos emerges. The reason that we are operating in the unknown while trading is based on the fact that we don’t know what is going to happen next. This is what makes trading an exploratory process by nature, full of risk. Once that position is in our book there are a unfathomable combination of possibilities that could manifest. Therefore, the #1 rule of trading has to be to manage your risk. I know, at this point your thinking “great another risk management post”, but just hear me out: fully accepting and embracing the nature of uncertainty in finical markets is what allows us to transform the unknown into a constant, like Peterson elaborated. If we are unable to or refuse to accept the possibility of our position trading against us we are going to be operating predominantly in the territory of the unknown, subject to our worst impulses and emotions. If the unknown becomes a constant, would that not make the unknown simultaneously know territory as well? I think that both of these forces are constantly in play with one another, but one must dominate our decision making (thinking) predominantly.

When we chose to trade, we elect to operate in an environment where there is risk and uncertainty.

Dr. Steenbarger Tweet

operating in known territory

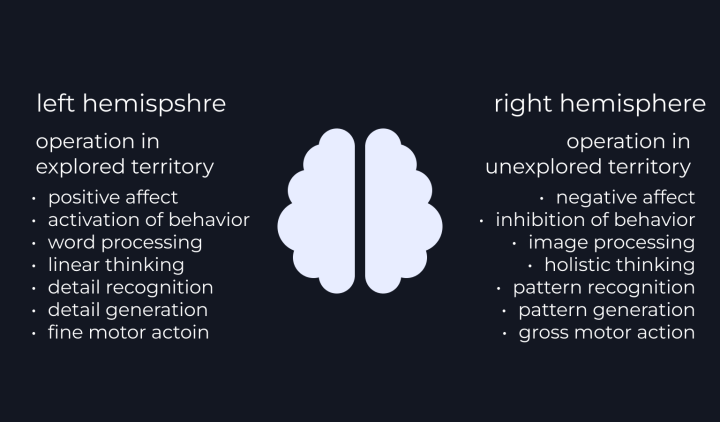

Good trading experiences originate from a sound state of mind. Once you have worked out and defined the aspects of your trading business (what principles govern your behavior, how do you operate day-to-day), making good trades is a result of a.) expressing your edge with favorable r/r and b.) increased baseline performance, a traders psychology. This then brings us back to the point of one state of mind will dominate our decision making, either we are operating in unknown or known territory (from a neurological perspective). It is our aim as traders operating in a world of risk and uncertainty, to operate from known territory (once again, from a neurological perspective). Described in the image below is how our brains operate when encountering either know/unknown territory. As you can see, when we are operating in unexplored territory we experience an inhibition of behavior. From the perspective of a novice trader, think about the reaction you have both physically and emotionally when price action threatens your trade thesis. For a moment you become paralyzed by the induction of the unknown. That is the inhibition of behavior. This experience can happen in seconds to minutes, depending on how you react to the situation. If you were to quickly close your position, that is your brain trying to protect your from further pain or “threats”. Now, imagine that when you entered this position you had a price level identified in which if price fell below that level, your thesis was wrong and you exit your position. This would allow the trader to accept the risk involved in the trade. When we are operating in the known territory, there are no threats present (until there are; think big red candle). Fully accepting the risk of any given trade frees us from the sense of uncertainty and will not lead to “inhibition of behavior”. Rather, a trader who acknowledges the risk and uncertainty involved is better equipped to deal with fake-outs, or holding through brief consolidation periods. When we accept the uncertainty of trading as constant, we can rise above our worst impulses.

your process is your safeguard

A fully sound, and well described trading process allows us to bring an element of certainty into the world of the unknown (financial markets, where there are no certainties). If you have not taken the time to describe in detail the components of how you are going to trade, it is likely that you have experienced a sense of “struggling well”, 1 step forward, 2 steps backwards. It is impossible to make sound trading decisions day in and day out if you are not treating your trading like a business. For the independent trader there are many roles to fill. Dr Steenbarger describes them as “trading buckets” in Trading Pscyhology 2.0. Here is how he grouped them:

- analyzing markets and market related data and gathering information and research

- synthesizing observations and research into trading ideas

- expressing those ideas as trades with superior risk/reward and assembling the trades into portfolios that provide superior risk/reward

- managing trades, including the taking of profits and losses and management of risk

- self management, the activities traders engage in to keep themselves in peak performance condition, cognitively, emotionally, and physically

If these concepts are completely foreign to you, there is likely a substantial amount of work to be done before you can feel comfortable with a trading process. All of these buckets can be broken down into minute detail and it would be a useful exercise to do so, as Dr. Steenbarger suggests in his book. Doing so would allow the trader, once again, to bring stability and order into their trading.

When we find ourselves giving into our worst impulses in trading, there are a few steps we can take to bring ourselves back to center.

- Breathe

- As simple as it may sound, taking conscious breathes is one way to de-activate the “inhibition of behavior” experience

- Zoom out

- Keep the big picture in mind. Do not get locked into smaller time frame movement between your entry price and target price. This is not to suggest that trading decisions must be made along the way, not every trade is target –> to entry… that sure would bring a sense of certainty, however that is just now how trading works

- Plan before executing

- Perhaps the most important element to avoid fear based decision making is to have a trading plan established before executing the trade

- Measure HRV (heart rate variability)

- I use Apple Watch while trading to track my heart rate level when I feel stress arousal. Doing so allows me to bring my conscious attention to my bodily responses to what is developing in front of me

- In a study published by Harvard Health , the author stated: “Think of HRV as another way you might tap into your body and mind as they are responding to your daily experiences.”

Making good decisions in trading is a result of your ability to establish your trading process so that you have something to lean on during turbulent market conditions; always mange your risk to avoid inhibition of behavior; realize that while trading there are many forces in play that makes the outcome of any given trade unknown, which brings a sense of chaos along with it, but you can bring the order into your trading with a sound trading process and risk management skills.

Risk management beings with the acknowledgement that there is much about the future that we don't know and that, at any give moment, we could very well be wrong.

Dr. Steenbarger - Trading Psychology 2.0 Tweet